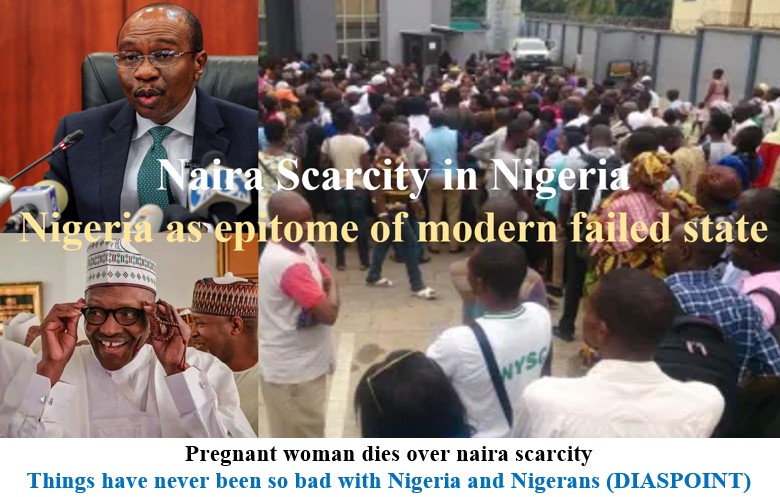

Pregnant woman dies over naira scarcity

A heavily pregnant woman in Kasuwan Magani, Kajuru Local Government Area of Kaduna State, lost her life due to the unavailability of the new naira notes in banks.

James Auta, the deceased’s husband, said his wife was rejected by the hospital when he could not make the payment due to failure to access cash in his bank and Point of Sale (POS) channels.

The incident happened early this month after Auta’s wife went into labour but was rejected, simply because her husband couldn’t make a payment due to naira scarcity.

It was gathered that the woman died at home after giving birth but continued to bleed. The incident caused concerns across the state as patients and their family members found it difficult to make payments to access treatments due to the naira shortage.

Daily Trust reports that the extended deadline to phase out the old notes was Friday, 10 February. However, the Supreme Court gave an order restraining the Central Bank of Nigeria (CBN) from enforcing the deadline for the phasing out of the N200, N500 and N1,000 notes, pending the hearing of a lawsuit brought by three northern states challenging the new currency redesign. It adjourned that hearing until 15 February.

The Attorney-General of the Federation, Abubakar Malami, is challenging that interim ruling by the Supreme Court and the central bank has not spoken on how it intends to comply with the ruling, thus leaving Nigerians confused.

President Muhammadu Buhari held an emergency meeting of the National Council of State on Friday to discuss crucial issues affecting the country including the currency crisis. However, Mr Buhari has not taken a decision on the cash crunch.

Parts of Nigeria have descended into chaos as frustrated Nigerians besieged ATM units in a bid to access their own money.

Violent protests have been recorded in parts of the country, including in Ogun, Oyo and Akwa Ibom in the country’s south, and social media is awash with lamentations of suffering Nigerians, who are not able to access their funds for transactions.

Meanwhile, the CBN has said that the Nigerian Security Printing and Minting Company Plc (NSPMC), has the capacity and enough materials to produce the required indent of the naira notes.

The apex bank also said that it was working to increase the circulation of the new notes across the country

The apex bank’s Director of Corporate Communications, Osita Nwasinobi, in a statement dated Friday but released on Saturday, said such reports about the Mint’s capacity to print the required banknotes that were credited to the governor of the bank, Godwin Emefiele, were not true as he was misquoted.

A medium had quoted Emefiele as admitting that the Mint did not have enough materials to print the new notes and that accounted for the current scarcity.

“The Mint has run out of papers to print N500 and 1,000 notes. They have placed orders with a German firm and De La Rue of the UK (for papers) but they have been placed on a long waiting list, so their orders cannot be met now.

“The Mint had received CBN’s request to print 70million copies of the new notes, totalling N126billion to be pumped into circulation by today (yesterday), The Mint doesn’t have the capacity,” the CBN governor was quoted as saying.

But, Nwasinobi said at no time did the CBN governor make such a statement during his presentation to the National Council of State at its meeting on Friday.

He said, “For the records, what Mr Emefiele told the meeting was that the NSPMC was working on printing all denominations of the naira to meet the transaction needs of Nigerians.

“While the CBN appreciates the concerns shown by all stakeholders about the distribution of the naira, we are alarmed at the extent to which vested interests are attempting to manipulate facts and pit the public against the bank.”

Nwasinobi also said the CBN remained committed to performing its monetary policy functions as stipulated in the CBN Act, 2007 (as amended).

He added, “We also wish to restate that the NSPMC has the capacity and enough materials to produce the required indent of the naira.

“The bank, therefore, wishes to appeal to the public to disregard the said reports and exercise more restraint, even as we work assiduously to increase the circulation of the new notes in the country.”

On a particular voice note trending on social media alleging that the CBN planned to shut down some banks, particularly in a geopolitical region of the country, the CBN director said there was no such plan and that the claims were illogical and did not comply with the workings of the banking system. Source: dailytrust